Bitcoin has been grabbing the headlines recently in a way that hits different.

More curiosity than suspicion. More are jumping on the band wagon. But not you.

You are curious but don’t know where to start.

If that sounds like you, read on!

I’ll take you from what money is and what problem is Bitcoin trying to solve.

This is your introduction to Bitcoin (derived from reading The Bitcoin Standard and my own research)

The evolution of money

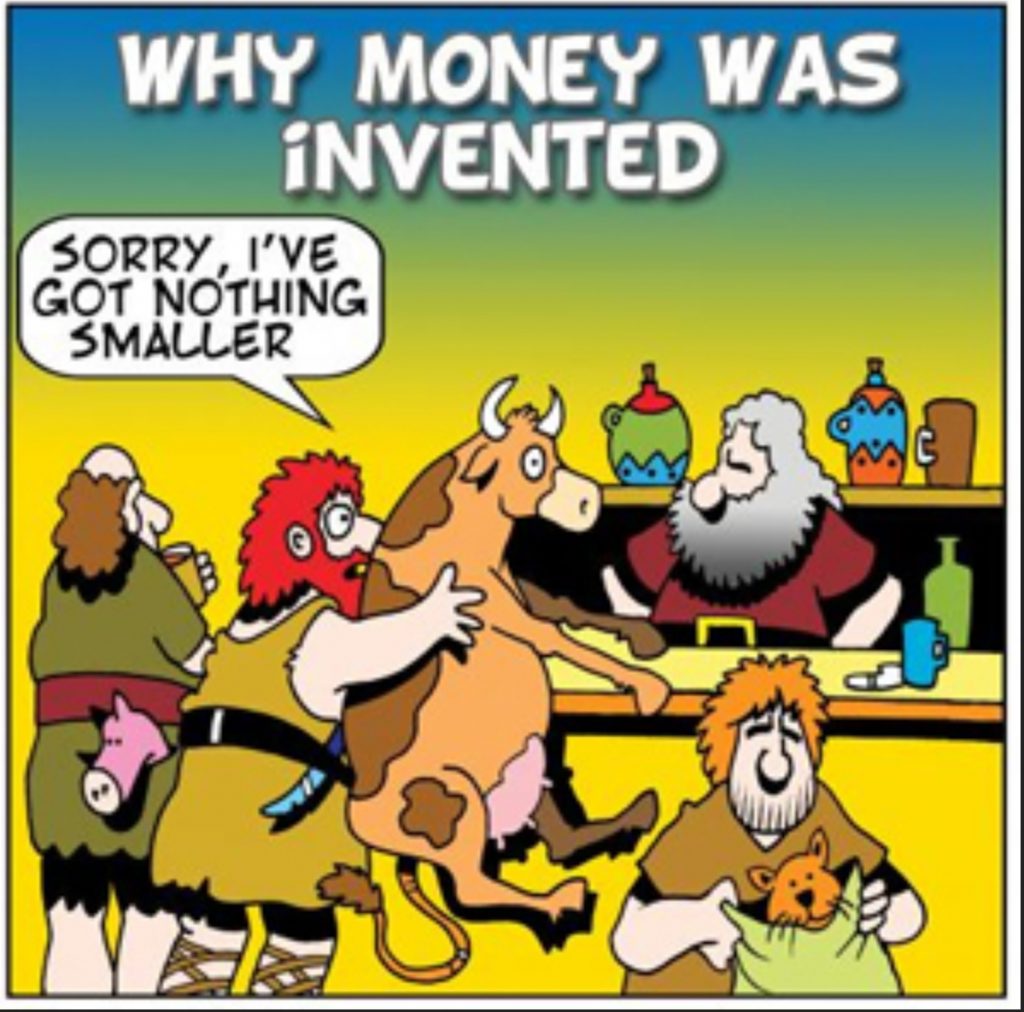

The exchange of goods started with bartering. But what happens if you don’t want what I offer for a trade? Or if what I offer is difficult to transport?

Enter the first currencies: Rai Stones, sea shells, salt (from where we get “salary”) etc…

But as technology improved, these media of exchange became easier to produce and therefore lost value.

We needed something rare and hard to produce.

That’s when gold and silver enter the scene. Their natural scarcity makes their value pretty consistent, no matter how technology improves. They also are universally accepted, which enables easy trading on a global scale.

At first, governments used them to mint coins. But soon, they started to use less and less of the precious metals. Money slowly became I.O U’s or a promise that said coin or note could be exchanged for an amount of gold should you require it.

Eventually though, governments turned their back on the gold standard by having their own currencies printed so that they could increase its circulation at will.

The problem with money nowadays

With so many different currencies in business, trading globally has become complicated. Exchange rates fluctuate constantly and have to be policed because in theory, countries can arbitrarily reduce or increase the value of their currency to attract investors or buyers, giving themselves an unfair advantage.

However, the policing does not prevent them from pumping cash into their economy, thereby racking up an ever increasing debt with little or no intention of paying it back.

The solution to every slump in the economy seems to be to print more money and encourage the public to spend, with not so much as an honourable mention about being able to afford it.

Money has become more and more detached from reality.

The reality though is that with the seemingly inexhaustible amount of cash the government prints, comes a decreasing buying power. It’s called inflation. Prices increase. Incomes don’t seem to catch up and savings earn less and less interest.

If we follow the government’s example and spend more than we have, we very quickly find ourselves in a bind. We get poorer and poorer. The reality that money is finite hits us hard.

How does Bitcoin compare?

There can only be 21 million bitcoins in circulation. The amount cannot be altered. It is set in stone in its algorithm. In that sense it comes back to reality. Money is finite.

What changes is the value of one bitcoin. It has gone from $0.30 in 2010 to $350 in 2015, then from $998 in 2017 to $13,412.44 in January 2018.

At the time of writing this post it has reached $30,000 in value.

This makes it an attractive investment. It outperforms traditional savings accounts, even traditional investment options I know of.

It has already made millionaires.

Although it is quite volatile, it cannot be argued that so far its value has skyrocketed over the long term.

I bought £25 worth of Bitcoin on December 26th on a friend’s (persistent) recommendation.

I’ve made almost £10 pounds in less than a month. This is an unbelievable return if I chose to sell now. If this trend continues, who knows how much it will be worth in a year? 5 years?

A balanced view

Of course there is no guarantee that Bitcoin will continue its rise or be adopted globally.

There are a number of issues at present. For instance, Bitcoin cannot compute the amount of transactions that it would require if the world was to switch.

It would likely need the help of intermediaries which would act like banks.

The industry is new therefore not really regulated. It is a breeding ground for scammers. Caution and research are a must.

The finance sector has to buy in (which I hear they are doing on the down low) if Bitcoin is to go mainstream and who knows what fees they will introduce and how the whole thing will pan out?

There has been attempts to hack Bitcoin itself but none has succeeeded thus far. However the possibility of one attempt succeeding is difficult to dismiss off hand although extremely unlikely.

All transactions are verified by a collective ledger. The process is difficult enough. It requires a lot of electricity and computing power. Hacking successfully would require an enormous investment hardly worth the return.

There are other cryptocurrencies that are trying to claim the top spot. They are called altcoins.

New ones spring up constantly but they don’t seem to have the level of durability and integrity of Bitcoin. They can all be altered by the few at the top.

Conclusion

Bitcoin is definitely of interest. I am dipping my toes just in case. I would not recommend spending on it more than you are able to lose.

Here in the UK I am using an app called Revolut to trade. It is legit and regulated. Coin base pro is a favourite internationally. However I intend to use a secure wallet in the future so I don’t lose out on fees.

But my priority is to put my finances in order because truth be told, I have been a big spender for far too long. I need to fix this.

I write about this here.

Reflect, redefine, rise!

R.

Leave a Reply